Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 20 in my cryptocurrency educational series.

Part 20 Reading Time: 37 minutes

Want to listen to this post instead?

12/29 Update: Added screenshots for each step of the Fantom liquidity staking section.

This is my fifth post specifically about investing in crypto, so I highly recommend you start with the previous ones if you haven’t read them yet:

- Part 16 (“Intro to investing)

- Part 17 (“Preparing to invest”)

- Part 18 (“More preparing to invest”)

- Part 19 (“Specific investing options”)

Last time, I explained three major categories of crypto investing that I consider lower risk. Now, it’s time to dive into the higher-risk-higher-reward categories.

Three warnings before we begin:

- I’m not an investment advisor, so please do not see this as a list of things I’m telling you to invest in. My goal here is to simply introduce you to all the major ways you might choose to invest in the crypto world. I’m not at all saying that these are right for you because I don’t know your specific situation.

- If you do choose to invest in any of the opportunities on this page, please remember that they involve higher risk than the first three categories (from Part 19), sometimes substantially higher risk. You could lose all the money you put in here, so, I would highly recommend you put no more than 5-10% of your total crypto investment into any of these when you’re just getting started. Once you have the basics covered (e.g., staking ETH and some experience playing around with DeFi), you might consider putting in more; but, please read other articles and watch other videos before you decide. Don’t just rely on me—or on any one person.

- Full disclosure, I’m invested in most of the opportunities I mention here. That’s why I’m telling you about them: because I believe that, for the right life situation and in the right allocation, they can be great additions to your portfolio.

By the way, this post is going to get complicated, but some of the opportunities I’ll go over have been getting returns of literally thousands of percent. So, it all depends on how much work you want to put in to understand this stuff and how much risk you’re willing to take on.

Here we go!

Category #4: Providing liquidity and yield farming

This is a very common category of investment for people who know what they’re doing in the crypto world, and it’s also where some of the highest risk and highest reward opportunities happen. I discuss this in more detail in Part 14 and Part 15. Make sure you know what you’re doing before you participate in one of these:

- Liquidity staking on a DEX (e.g., Uniswap, Sushiswap)

- Providing single-sided liquidity (e.g., Bancor)

- Autocompounding yield farming (e.g., Auto CAKE on PancakeSwap, staking on Alchemix)

My overall experience with these has honestly been mediocre.

Because of issues like impermanent loss (where you lose money when one of the coins or tokens in the pool pair is more volatile than the other), this is the category that’s actually lost me the most money of all my crypto investments. I made a lot of mistakes early on trying to provide liquidity on Uniswap and Sushiswap, so I want to stress how much research is required here to do this successfully and consistently.

As another example, the Auto CAKE pool on PancakeSwap was serving me very well for several months (70%+ APR), and then the price of CAKE (which the pool was delivering rewards in) dropped a lot and I lost most of my profits.

Bancor has been excellent overall with its impermanent loss protection, but the big problem is that re-staking my rewards hasn’t been possible for me because Ethereum’s high gas fees would eat into too much of the profits. I’m excited for Bancor to launch on Arbitrum Layer 2 in the coming months, which should have much lower fees.

All that said, liquidity staking seems to be hugely profitable for a lot of people in the crypto community, so maybe I’ve just been doing it wrong (or, the more likely truth is that my attempts have been focused on higher-APR liquidity staking opportunities; and, if I’d instead concentrated on providing liquidity on pairs of stablecoins only, I would probably have achieved lower APR’s but more consistent returns).

If you want to really understand the crypto world, you should probably try liquidity staking yourself at least once. Here’s how:

All of this is an important part of DeFi, so I think it’s worth trying it out yourself to actually feel what it’s like. I recommend doing so on the Fantom blockchain since it’s very fast and much cheaper than Ethereum (as of late December, we’re talking about a swap fee of $0.10 USD on Fantom versus $50 on Ethereum).

It’s a lot easier than you might think to get started on Fantom. Here are the steps:

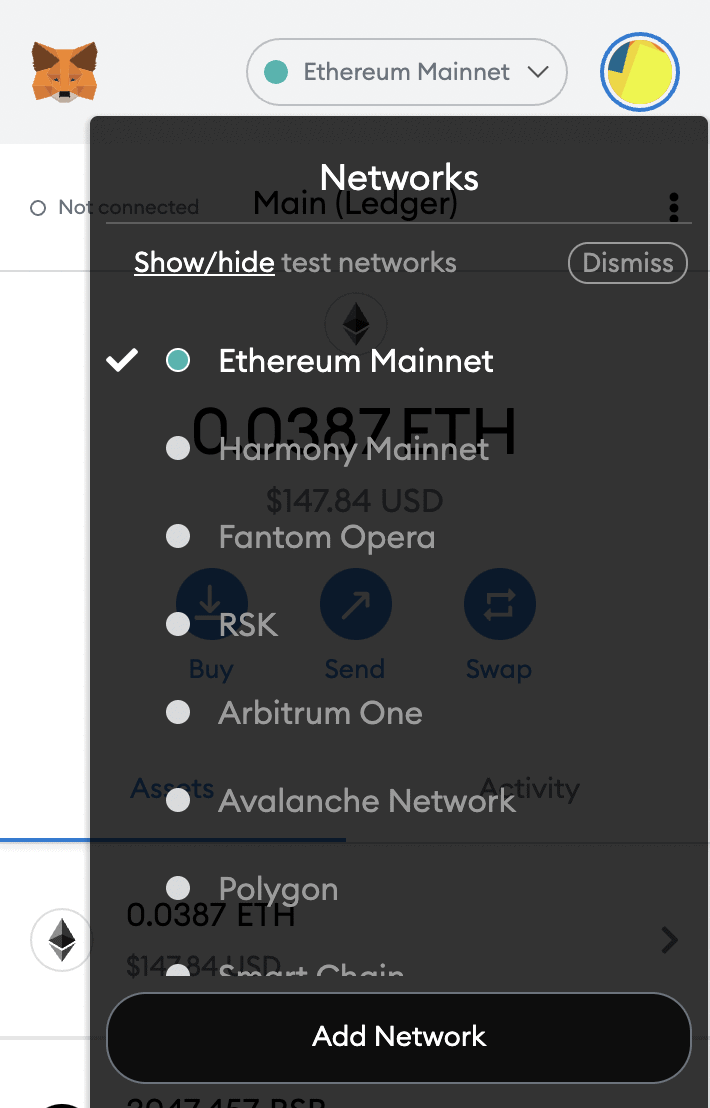

First, set up your Fantom wallet on MetaMask. Once you’ve done that, you can switch between Ethereum and Fantom by opening MetaMask and hitting the dropdown menu at the top that probably says “Ethereum Mainnet.”

Now, you have two options to get money into that wallet:

- First, you could buy native FTM on the centralized exchanges Crypto.com or Gemini. This is the easiest way if you have an account at one of those exchanges. (Note that KuCoin claims to offer FTM, but they don’t let you withdraw it onto the actual Fantom blockchain—for now at least.)

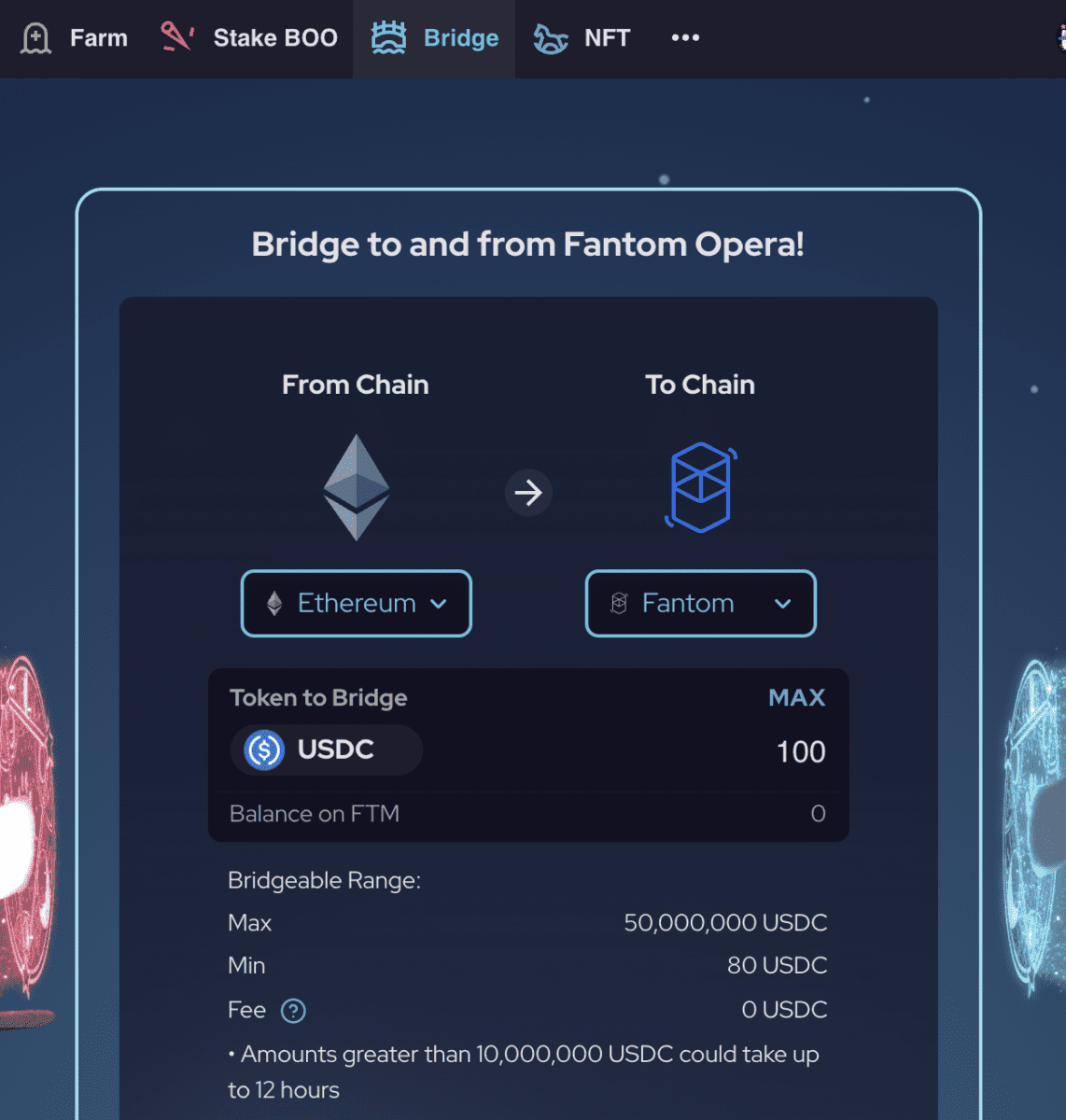

- Second, you could transfer crypto from another blockchain (like Ethereum) onto Fantom using the SpookySwap Bridge. It’s easy and surprisingly cheap to move USDC or the ERC-20 version of FTM from another chain like Ethereum, Binance Smart Chain, or Polygon. This is what I do, and the gas fee for sending it off Ethereum is surprisingly low. Also, it’s normal for the bridging process to take an hour or more.

- You can buy USDC on Coinbase or whatever on-ramp, then use the SpookySwap Bridge to move that from Ethereum to Fantom. From there, go to the Swap page on SpookySwap to convert USDC to FTM.

- As another example, when I stopped farming CAKE on PancakeSwap (on the Binance Smart Chain blockchain), I used PancakeSwap to convert my CAKE to BNB (the main coin of Binance Smart Chain), then I used SpookySwap Bridge to transfer my BNB from Binance Smart Chain to Fantom. From there, I converted the BNB to FTM on SpookySwap, the main DEX of Fantom.

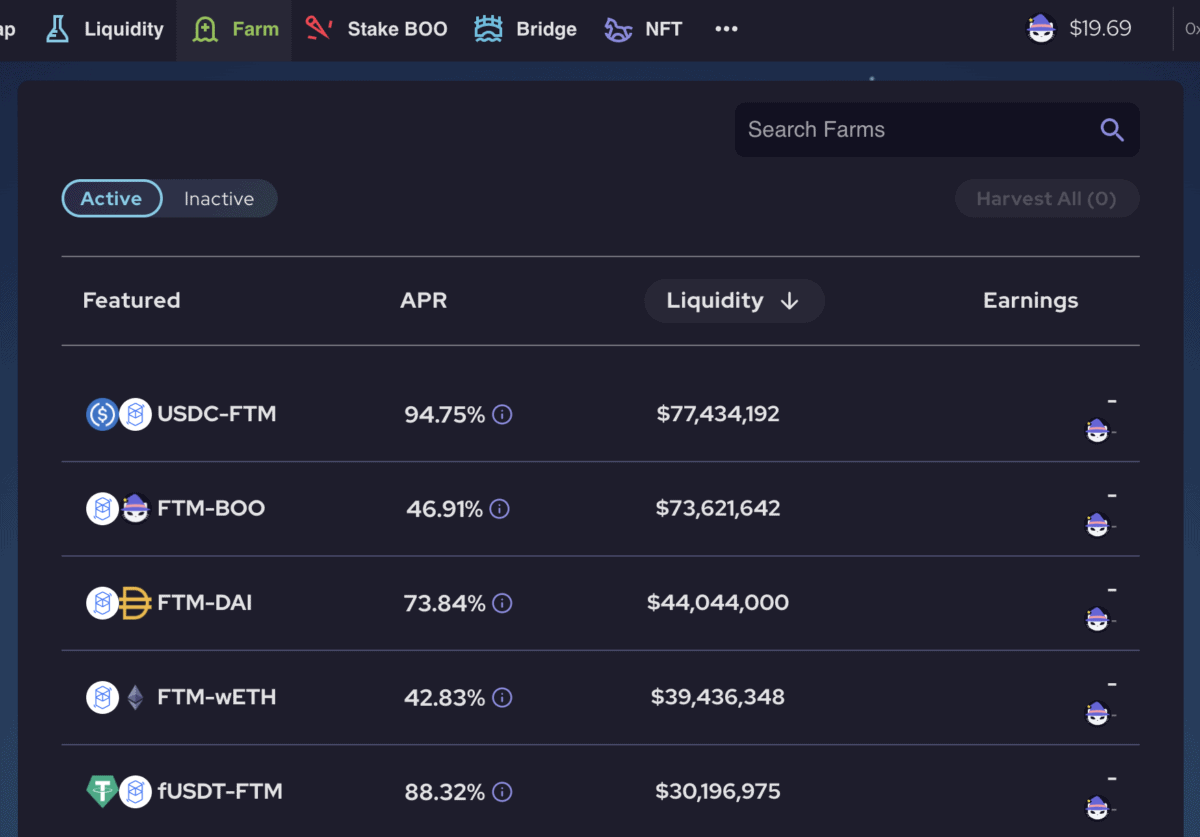

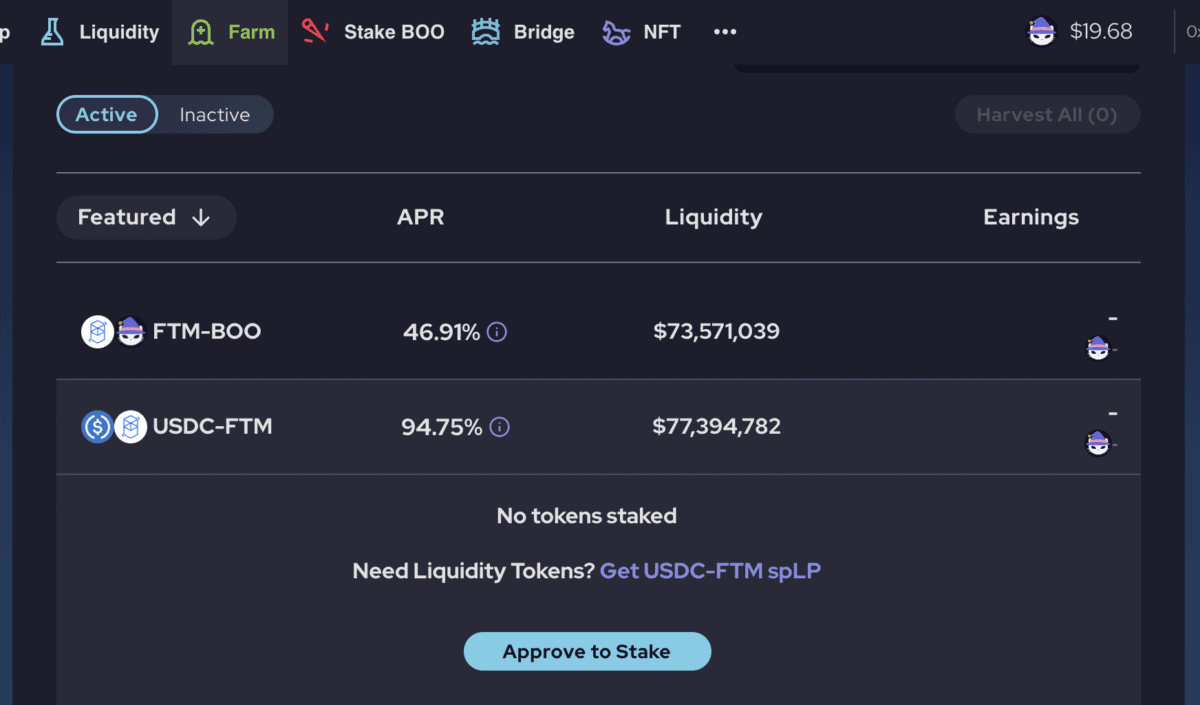

Once you have FTM, go to SpookySwap, visit the farms page, and browse the list of options. Sort by Liquidity to get a sense of which pools are most popular and likely safer. Like I explained in Part 14, you should get less impermanent loss in pools with a stablecoin. So, if I were picking from this list at the time of writing, I’d probably go with USDC-FTM because I recognize both those tokens and I believe that FTM should keep rising in price; plus, the APR is over 90% at the time of this writing (it fluctuates quite a bit though).

In other words, if you provided liquidity here for a year and the APR remained stable, you’d nearly double your investment—and this is with two tokens that seem pretty safe to me. (Again though, that APR will not stay where it is, and there’s always the chance that SpookySwap could get hacked or otherwise fall apart.)

When you click the USDC-FTM farm, it’ll give you a link to “Get USDC-FTM spLP,” which is the LP token you’ll be farming. In other words, it’ll link you directly to the liquidity staking page with the two tokens pre-filled in: USDC and FTM. You’ll need an equal value of both.

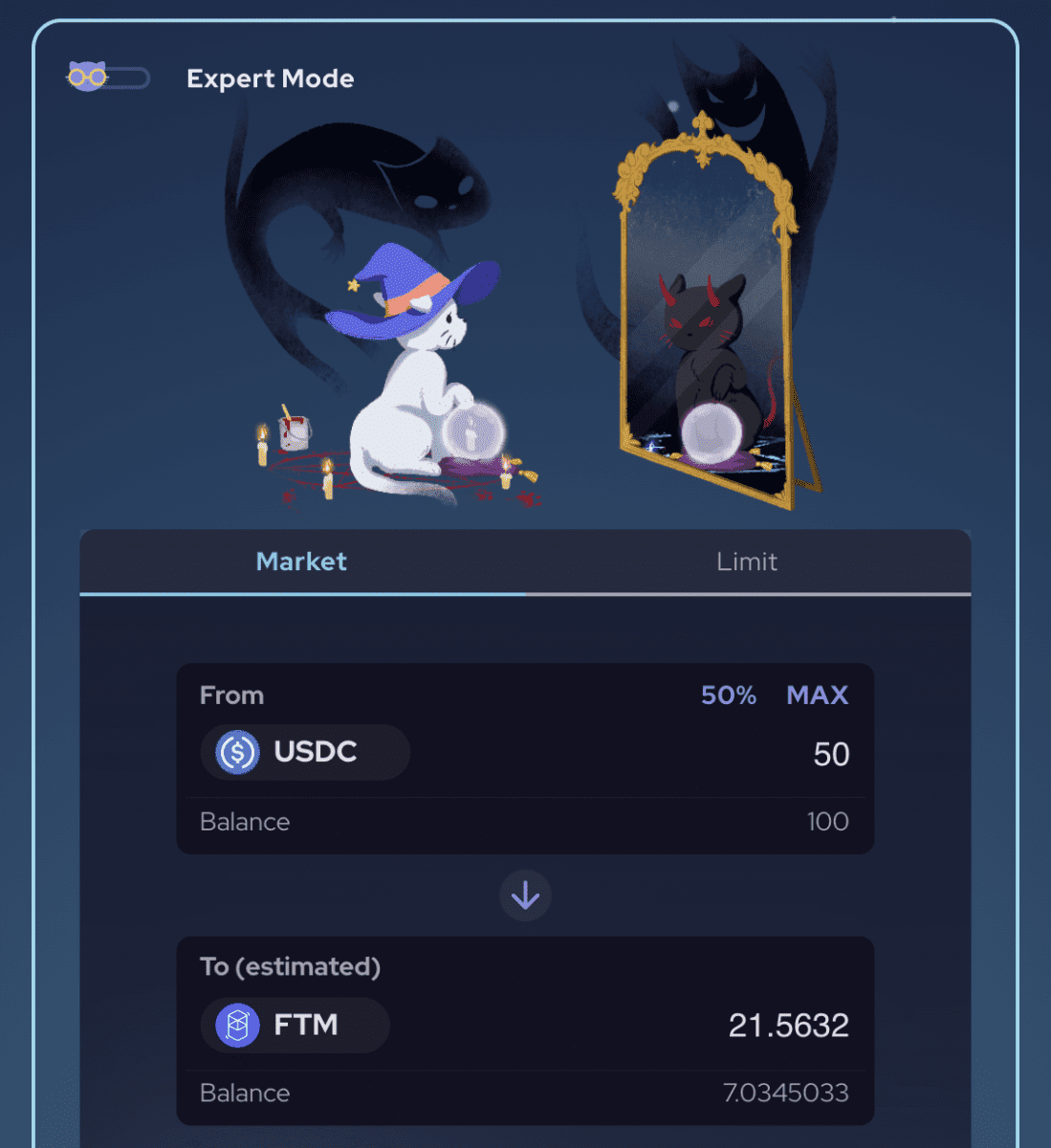

So, let’s say you only have USDC and you need FTM. Go to SpookySwap’s Swap page, connect your wallet (make sure you open your MetaMask first and switch the top dropdown to be Fantom). Now, select USDC in the “from” field, hit the 50% button to select half of it, then choose FTM in the “to” field. Once you’ve converted, you should have half USDC and half FTM.

Go back to the farms page, select USDC-FTM, and click that link again to get the LP token. You should see USDC as one ingredient and FTM as the other.

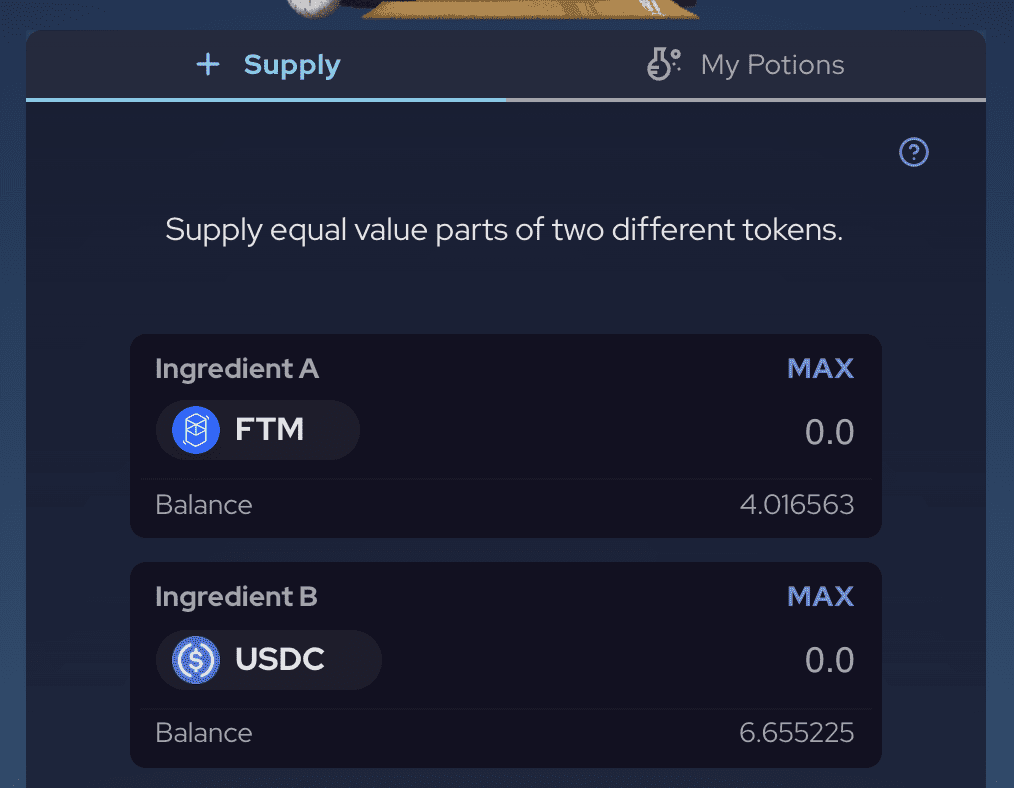

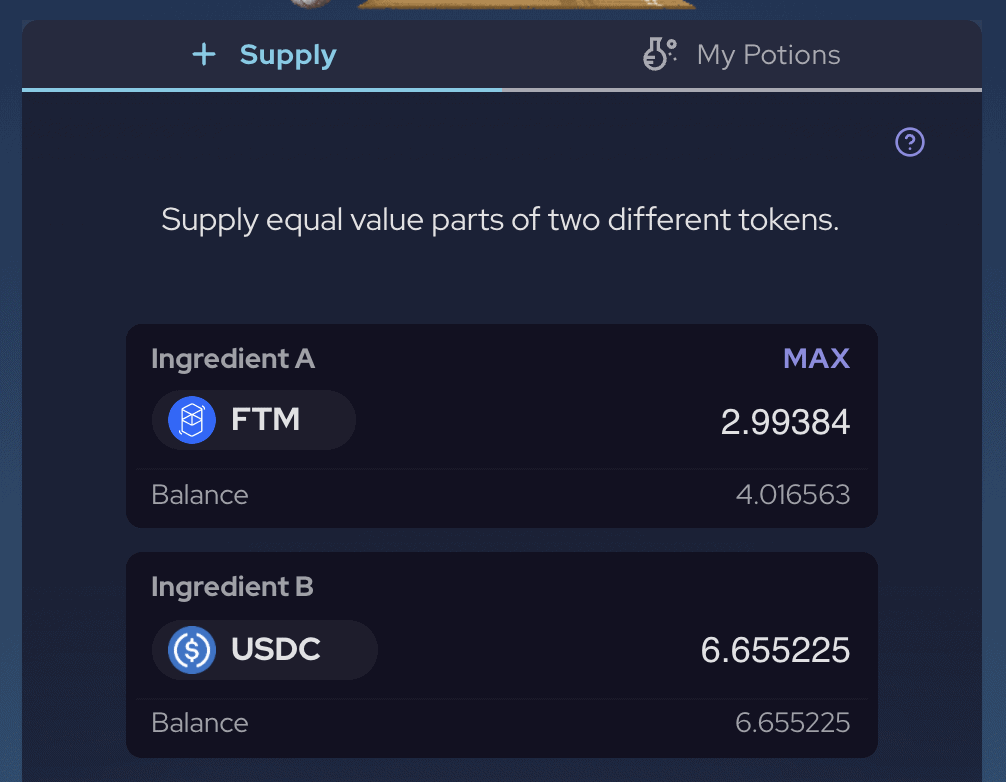

Remember that the idea here is to provide an equal value of each. The “max” buttons make this easy, but there’s one potential snag to watch out for. Notice what happens when I hit the “max” button in Ingredient A:

You can see that Ingredient A is fine because it wants to put in 3.01 and I have 4.01. But, with Ingredient B, it shows that it’s trying to put in 6.7 but I only have 6.6. So, if it’ll give me an “insufficient balance” error if I try to move forward with that.

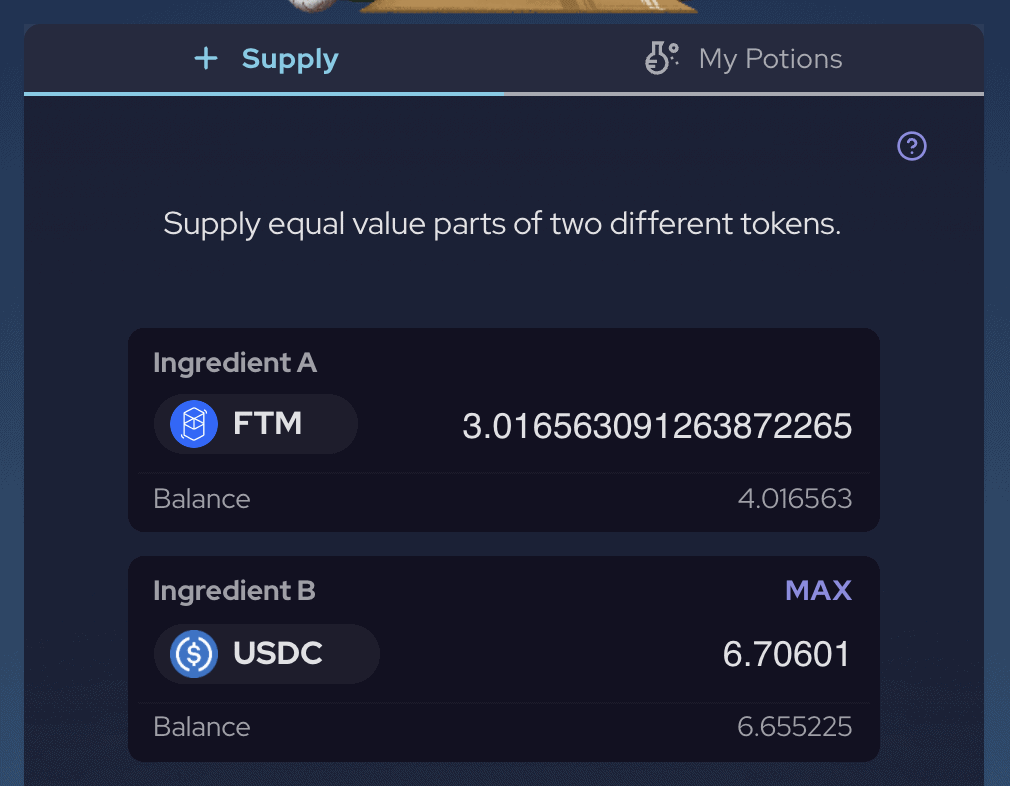

Instead, watch what happens if I hit the “max” button on Ingredient B now:

Now you can see that I have enough of each.

Bottom line: Just try hitting one of the “max” buttons and check if you have enough balance on each ingredient; if not, hit the other “max” button instead.

Also: It’s very important that you leave yourself some FTM since that’s how gas fees are paid on the Fantom network. If you convert all your FTM to something else, you won’t be able to execute any more transactions, including converting something else to FTM. The only solution will be to get more FTM by bridging it in from another blockchain or by buying it on a CEX like Crypto.com.

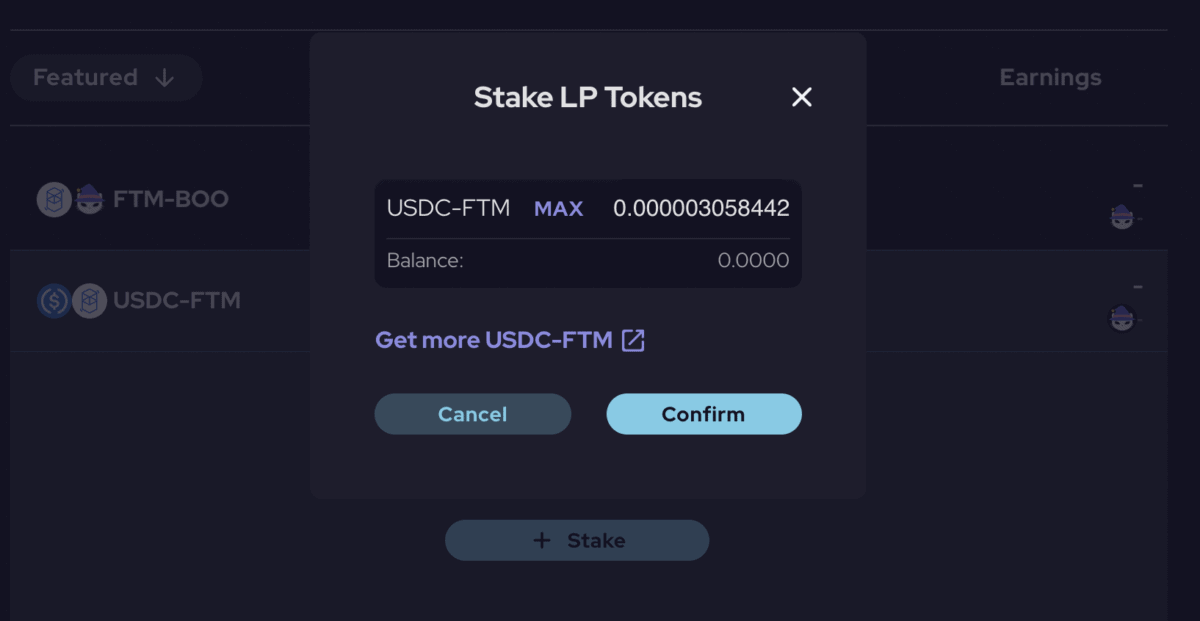

Once you have your LP tokens, you can head back to the farms page, select USDC-FTM again, approve the stake, then stake your LP’s (select “max” on that screen).

That’s it—you’re now earning 90+% APR (or whatever the rate is when you do this).

You can see that this USDC-FTM pool will generate BOO (the token of SpookySwap). At any time once it’s accumulated, you can come back here to harvest it (i.e., to take the BOO into your wallet, which you can then convert to USDC or whatever else on the Swap page).

Depending on how much money you’re investing here, you might want to only harvest once a week or once a month. Or, if you’re more aggressive, some people even harvest multiple times a day and then reinvest those gains into the same farm (to do so, you’d have to swap half your BOO for USDC and half for FTM, then provide liquidity on that pair again and stake the resultant LP tokens here).

When you feel done with this farming, you can unstake your LP token and then go back to the Liquidity page to convert it back into USDC and FTM.

Remember that although USDC is stable, the value of FTM will fluctuate, so it’s entirely possible that you’ll end up losing money if the price of FTM drops. Luckily, gas fees are so low on Fantom that you can experiment with even a small amount of money.

Again, I highly recommend you actually do this yourself, even with just $50—there’s something very different about clicking all the buttons yourself that will help this knowledge sink in more deeply than just reading about it.

Category #5: NFT’s

There are many different types of NFT’s you can collect, trade, or even create yourself. I discuss buying and selling NFT’s in more detail in Part 11. Two main approaches here:

- Buying and holding whole NFT’s (e.g., Bored Ape Yacht Club, VeeFriends, or many thousands of smaller ones that are less famous)

- Buying and holding fractionalized NFT’s, i.e., a piece of an expensive NFT that you probably wouldn’t be able to afford otherwise (e.g., CryptoPunks, Ringers)

Overall, NFT’s have earned me a little profit, but I’ve felt too intimidated to put much of my money into this category. It’s tricky because many of the best-bet NFT’s are very expensive (i.e., tens or hundreds of thousands of US dollars), and I’ve hesitated to put too many of my eggs in one basket.

This category has also been by far the place where I’ve missed out on the most potential profits. Months ago, I was watching right when collections like VeeFriends and Bored Apes launched, and I even had the webpages open and ready to go on the launch dates. But, back then, I just couldn’t bring myself to spend thousands of US dollars on a single NFT (and, I didn’t like the art style of Bored Apes).

In retrospect, I would have made at least a hundred thousand dollars profit on the items I was seriously considering. Ugh.

To be fair though, I probably wouldn’t have held on. That’s the challenge with all this: Say I bought an NFT for $5,000 and the price doubled to $10,000. I would most likely have sold at that point. Even if I hung on, if it doubled again to $20,000, I know it would have felt way too greedy to me to keep holding. So, it seems extremely unlikely that I would have held on all the way to $100,000 and beyond.

And things are very different now than back in Spring 2021. Back then, it still felt like those of us who understood NFT’s were part of a secret club. Nowadays, NFT’s are on major magazine covers, and venture capital firms are investing millions into them. So, it’s become a lot harder to make huge profits here.

Also, please keep in mind that over 90% of the NFTs being minted lately are probably going to be completely worthless in a few years.

That’s why if you want to invest in NFT’s, my recommendation might be to just put some money into famous fractionalized NFT’s like CryptoPunks, Autoglyphs, Chromie Squiggle, Ringers, or even culturally-relevant meme NFT’s like the original DOGE image; then, hold those for, say, 5-10 years. They might end up being the “Mona Lisas” of the digital generation.

Or, if you’re excited to put in some serious time and effort here, you can try to track the space and pick up-and-coming artists. Start by following savvy people like DCInvestor and Kevin Rose.

One last warning here: If you’re going to buy an NFT on OpenSea (the largest marketplace), make sure you understand what blue checkmarks mean. Also, customize your spend limits.

Next up, we’re getting into two categories that become more complicated to understand but that offer incredible returns.

Category #6: Complex “DeFi 2.0” opportunities (e.g., OlympusDAO & its clones, Tomb Finance)

There are a variety of brand-new types of opportunities that have been popping up over the past couple of months.

The big one that’s taken the crypto world by storm is OlympusDAO. It’s been so revolutionary and popular that many people are calling it the first major platform of “DeFi 2.0.” And, it’s spawned all sorts of copies like Wonderland, KlimaDao, Jade Protocol, and more.

Another even newer platform the community has been excited about is Tomb Finance and its clones.

So, in this section I’ll cover two types of investments:

- High-risk, seemingly magical opportunities that are basically related to a DeFi platform owning its own treasury and providing incredible APY to stakers (e.g., OlympusDAO, Wonderland)

- Innovative stablecoins pegged to the value of a blockchain coin (e.g., Tomb Finance, Bomb Money)

The returns here are mind-boggling (think tens of thousands or even a million percent APY), so tread very, very carefully. There’s a very real risk that all the money you put into one of these could suddenly vanish (and, indeed, many of the clones of OlympusDAO and Tomb Finance have failed and/or turned out to be rug-pulls). In other words, a lot of people have lost their entire investments here.

That said, I still personally have a good amount of money in this category, but I’ve been very careful about which platforms to put it in, and I’ve spread out my investment to reduce my risk.

This is a good time to remind you of the difference between APR and APY.

A lot of liquidity pools report their returns in terms of APR—the raw percentage return in a year on your original investment. On the other hand, APY assumes that you’re regularly taking profits from that investment and re-investing them to compound your gains.

Part of the magic of these OlympusDAO-type investments is that they auto-compound for you, typically every 8 hours (that’s what they refer to as “rebasing”).

It’s critical that you understand three things here:

- If something promises an APY of, say, 1,000%, you can’t simply divide that by 12 to get the expected monthly return. Instead, the returns will start out much lower, but they’ll grow over time.

- Check out this APR to APY calculator to play around with some numbers, and this will hopefully start to make more sense. For example, an APR of 350% not compounded will yield an APY of 350%; but, compounded monthly, it will get an APY of 2,056%, and that same APR compounded daily would be 3,156%.

- That calculator doesn’t have an option for compounding every 8 hours, but it would be nearly 4,000% if I did the manual calculation right in Excel. So, in that case, if the website promised an APY of nearly 4,000%, it would actually only be an APR of 350%.

- It’s extraordinarily unlikely that those returns will stay steady for an entire year.

- So, if one of these things promises 1,000% APY, it’s simply saying that, if the current APR stayed steady and continued compounding every 8 hours for a whole year, you’d end up with 1,000% return, or even 1,000,000%, or whatever it might be promising. But the reality is that there’s no way the APR will remain steady, and many of these OlympusDAO copies probably won’t even still be around a year from now.

- All of this is also dependent on the price of the underlying asset that you’re staking and being rewarded in. That 1,000% or 1,000,000% APY assumes that the price of OlympusDAO’s token or whatever token remains steady. If instead it declines in value, so too will your returns.

- The general trend with these OlympusDAO copies is that they explode in popularity right when they’re first released, offering ridiculous APY’s of a million percent or more. The price of the token shoots up, so all the people who bought in right away are rewarded, and then the token price starts declining a few days or weeks later as those original people get out. Some of that phenomenon is probably an intentional pump-and-dump, but some of it is simply that people are greedy and it’s not necessarily that the creators of that platform were trying to screw anyone over.

Here are the best options of this type (as of December, but this space changes very quickly):

Again, this category has exploded lately, so it can be hard to keep track of all the opportunities here (many of which are extremely high-risk and might very well turn out to be rug-pulls).

But as of December, here are some of the ones I’ve personally decided to trust, at least for a little while, in my rough order from most trustworthy to least:

- OlympusDAO (OHM/gOHM) on the Ethereum blockchain (current APY: 5,197%)

- Wonderland (TIME/MEMO) on the Avalanche blockchain (current APY: 70,784%)

- HectorDAO (HEC/sHEC) on the Fantom blockchain (current APY: 91,113%)

- KlimaDAO (KLIMA/sKLIMA) on the Polygon blockchain (current APY: 26,231%)

- Euphoria (WAGMI/sWAGMI) on the Harmony blockchain (current APY: 248,254%)

- Jade Protocol (JADE/sJADE) on the Binance Smart Chain (current APY: 102,872%)

- Umami (UMAMI) (formerly known as ZeroTwOhm) on the Arbitrum blockchain (current APY: 73,338%)

Please don’t take this as an endorsement of any of them, though, except maybe OlympusDAO. I’ve been very careful with my risk management here to spread out my money across all of these and not invest too much in any one of them—or too much in this category overall.

So, to me, there are two viable strategies here:

- Stick with the original OlympusDAO that actually has a chance of staying viable long-term, or

- Put a lot of time and energy into this space to track the newest platforms, vet them, decisively jump in, then get out before the price drops.

Don’t get me wrong: There can be a lot of money to be made here with that second approach (as you can see with the APY’s in the tens or hundreds of thousands)—but it requires following the right people on social media, having a lot of capital to work with, having the time and energy to devote to all this, and properly managing your risk and asset allocation.

These are not “buy then check back in six months” type of investments. These require active management. (As an example, it took me a month to notice that ZeroTwOhm had rebranded and relaunched as Umami, and I had to manually swap my Z2O tokens for UMAMI to keep receiving rewards. I would never have realized it unless I regularly checked their Twitter, Discord, or website.)

So what even are all these things?

Intro to OlympusDAO

It’s not easy to understand or explain how OlympusDAO works, but here’s my attempt:

It’s basically aiming to be an algorithmically-driven stablecoin that uses game theory to encourage everyone to keep staking instead of pulling out.

This type of stablecoin is not pegged to any fiat currency (like US dollars)—instead, the price of OHM (OlympusDAO’s token) constantly fluctuates. It’s not meant to stick to around $1 like typical stablecoins or even other algorithmically-derived stablecoins like UST.

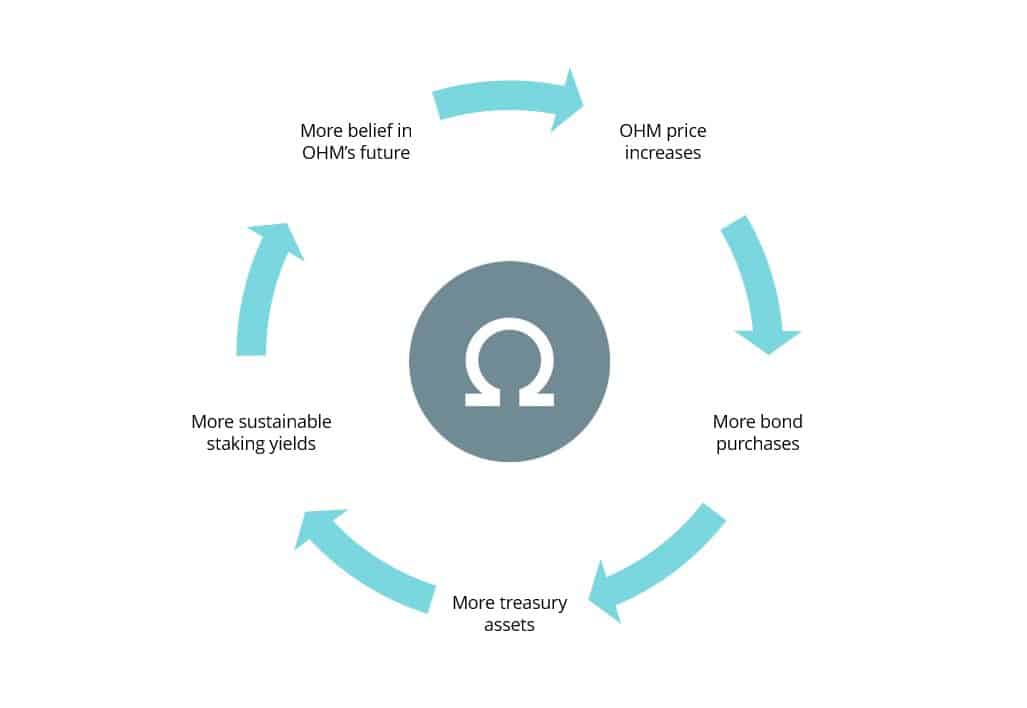

OlympusDAO’s major innovation—the thing that makes some people call it DeFi 2.0—is that it controls its own liquidity.

As I explained in Part 15, most new crypto tokens rely on the “crowdsourced liquidity” of DEX’s (i.e., decentralized exchanges like Uniswap) to get off the ground. Those project teams will ask early supporters to provide liquidity on that new token on a DEX so that other people can buy into it.

And that works great—until people stop providing liquidity. If everyone pulls out to hop onto the latest new yield farming opportunity, the old token might lose enough liquidity that it becomes hard to get in large quantities and then the project suffers.

This has become a big problem in DeFi, and OlympusDAO offers a solution: Instead of relying on a DEX to provide liquidity for OHM, OlympusDAO allows its users to provide liquidity directly on the platform through “bonding.”

By bonding other tokens like the stablecoin DAI or wETH (wrapped Ethereum) on the OlympusDAO platform, those tokens get added to the OlympusDAO treasury; and, in exchange, those users get a discounted price on OHM to stake there too. Bonding is basically just like staking except you’re not allowed to pull out for five days.

Since OlympusDAO controls its own liquidity, if there’s a bank run (i.e., lots of people suddenly trying to withdraw all their OHM at once), the OlympusDAO system should be able to stabilize things.

They explain in their documentation that most stablecoins optimize for stability and consistency, whereas OlympusDAO has chosen to sacrifice that at the beginning and optimize for volatility and thus profitability instead, which leads to growth.

Check out this helpful graphic from Ryan Watkins:

OHM is not backed by a fiat currency or traditional asset like gold. Instead, it relies on that bonding mechanism to fill its treasury with other crypto tokens that it uses to back the value of OHM.

Here’s the craziest part though that took me a while to understand (well, “kind of” understand at least): OlympusDAO decided that each OHM only needs to be backed by $1 worth of collateral (typically the stablecoin DAI), even though an OHM is currently worth nearly $500.

That didn’t make sense to me that an OHM priced at $500 would only need $1 of backing. But what I didn’t realize until I did more research is that traditional banks already operate like this.

I’m definitely not an economist, and this stuff gets very complicated, but check out this quote from Investopedia:

“In a fractional reserve system, only a fraction of a bank’s deposits needs to be held in cash… The magnitude of this fraction is specified by the reserve requirement… If the reserve requirement is 10% (i.e., 0.1) then the multiplier is 10, meaning banks are able to lend out 10 times more than their reserves.”

And, get this: “In March 2020, the Board of Governors of the Federal Reserve System reduced reserve requirement ratios to 0%, effectively eliminating them for all depository institutions.”

Again, I won’t claim to fully understand all that, but it sure sounds to me like, even though OlympusDAO is only requiring each OHM to be backed by $1 worth of other assets, that’s actually better than what the United States Federal Reserve has been doing.

In fact, thanks to all that bonding, OlympusDAO actually has the eleventh largest treasury in all of crypto: nearly $200M, ahead of platforms like Yearn and SushiSwap.

This stuff is pretty confusing, but here are some good places to start reading if you want to try to better understand OlympusDAO and OHM:

- https://www.youtube.com/watch?v=it5q_sZWmQo

- https://twitter.com/ishaheen10/status/1413369807450247168?s=21

- https://newsletter.banklesshq.com/p/wtf-is-olympus-dao

- https://every.to/almanack/olympus-dao

- https://www.reddit.com/r/olympusdao/comments/rr69nk/i_wrote_a_thing_about_olympusdaos_economics/

One more wild concept to think about: Because the APY is so high, even if the price of OHM drops a lot, you should still make money—eventually. At the time of this writing, OHM is $378 and staking it earns you 0.36% every 8 hours, or 1.08% per day. At that rate, even if the price of OHM dropped by 50%, after six months you’d still more than triple your initial investment.

Of course, that interest rate is not at all fixed (and it’s already dropped quite a bit from where it was a couple of months ago), which is why this is still a risky investment. (It’s also a risky investment because I still don’t feel like I fully understand how this thing even works.)

Ok, one more interesting new DeFi platform that’s caught my eye lately:

Intro to Tomb Finance

Tomb is meant to be a stablecoin based on FTM (Fantom). Transactions on the Fantom blockchain are fast and low-cost, which is why I recommended it earlier to get you started in DeFi. However, that speed relies on nodes, and nodes rely on node owners staking a lot of FTM. If too many FTM coins of the total supply are staked though (i.e., locked in and not able to be used), liquidity on that coin becomes low.

So, the team behind Tomb Finance decided to create the TOMB token, which is meant to be a 1:1 peg of FTM. The idea is to give the Fantom ecosystem more liquidity since you could own either FTM or TOMB. And what’s nice about providing liquidity on the FTM-TOMB pair is that there should be very little impermanent loss (because the price of FTM and TOMB is meant to be synced up).

This gets more complicated of course; but, within the Tomb ecosystem, there are actually three important tokens: TOMB, TSHARE (Tomb Shares), and TBOND (Tomb Bonds), and they all work together to help keep the price of TOMB pegged to the price of FTM.

I haven’t personally gone too deep into Tomb yet, but there are at least a couple of different ways you can make money here:

- Liquidity stake in the TOMB-FTM pool on SpookySwap (remember that TOMB is pegged to FTM, so there should be almost no impermanent loss here). Then, you can take those LP tokens and farm them in the “FTM-TOMB Tomb Crypt” on reaper.farm. The APY is currently over 300%. That’s a pretty incredible return for a pair that should theoretically have no impermanent loss.

- Note though that farming on reaper.farm is probably riskier than doing it on Tomb Finance directly, but the difference is that you’d currently get 336% yield on Reaper but “only” 151% directly on Tomb. Again, you’ll have to decide how you want to balance your risk and reward.

- Alternatively, instead of working with the TOMB token, you could work with the TSHARE token I mentioned above. To do so, you’d liquidity stake in the TSHARE-FTM pool on SpookySwap, then farm those LP tokens in the “FTM-TSHARE Tomb Crypt” on reaper.farm. There will likely be more impermanent loss here, but the APY is currently over 1,300%.

How should you choose between the two? As always, the higher the APY the more risk you’re dealing with, so I’d recommend putting only a small amount into TSHAREs.

Some people in the crypto community have been speculating that, just like OlympusDAO has led to a lot of clones, the same thing might happen with Tomb Finance. It’s already happened at least once with Bomb Money, a Tomb fork on the Binance Smart Chain.

By the way, it’s also worth mentioning here that reaper.farm had a competitor, grim.finance, that many of us were using to stake TSHAREs and TOMB LP’s. Unfortunately, it experienced a major hack on December 18th and over $30M USD worth of crypto was stolen. I personally lost several thousand dollars here, even though I took all the precautions I’ve explained in previous posts on security.

This was an exploit on the platform side, so there was nothing that I as a user could have done to prevent it. It’s just another reminder to spread out your risk and not invest too much in one place. Also, like I said, all the opportunities on this page are higher-risk.

Summary of “DeFi 2.0”-type opportunities

In my opinion, these “OlympusDAO” and “Tomb Finance” type investments are definitely not “set it and forget it.” This space is changing so quickly that you might lose all your money here if you don’t keep up-to-date on the latest risks and opportunities. So, don’t invest in these unless you’re prepared to check Twitter and Reddit at least several times a week, if not daily.

The best people I’ve found to follow for this type of info are Green Pill and Steven the Calculator Guy. But please recognize that Green Pill especially invests in extremely high-risk opportunities, many of which I would stay away from even with the money I’ve set aside for the riskiest possible investments.

You might be ok leaving money in OlympusDAO itself for a few months, but many of its clones are imploding every day. As always, it depends on how much time and effort you want to put into all this. The safest play in this area is to just stick with OlympusDAO, and even that isn’t safe compared to the other categories I outlined in my last post.

But, the much riskier play here that could also get you double or more the profits of even OlympusDAO is to track the latest OlympusDAO clones and move your money from one to the other—getting in early when a new one launches, sticking with it for a few days or weeks, then moving to the next one.

If you do this though, you need to be very aware that rug pulls are quite common here. So, use a separate wallet for high-risk plays, don’t put too much into any one of them, and follow people like Green Pill who are closely tracking this space.

—

That’s it for today!

Next time, I’ll finish up with Category #7—the one that has given me personally my greatest, most consistent returns by far. After that, I’ll try to put all seven categories into perspective for you in terms of risk and reward.

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.