Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 9 in my cryptocurrency educational series.

Part 9 Reading Time: 28 minutes

Want to listen to this post instead?

This was one of the most interesting (and challenging) posts in this series for me to write.

Why? Because NFT’s are the single topic in the crypto world that I most radically changed my mind about—from thinking they were ridiculous to believing they have a huge amount of potential.

I’m excited to explain.

But first:

Let’s quickly review Ethereum (and add a few more details) to make sure you understand before we continue.

Last time, I explained some key concepts:

- Ethereum is the most popular cryptocurrency after Bitcoin. It works like a multipurpose vending machine, allowing you to easily pay ETH (Ethereum) to purchase one of the items being offered.

- The “vending machine slots” are all dapps (decentralized apps) containing smart contracts, so when you “buy something,” you’re triggering that dapp to run.

- Anyone can create a new dapp to be offered via the “vending machine” since the dapps run directly from websites (there’s no app review process like with the Apple app store).

- In other words, when I use the “vending machine” analogy, I’m talking about something on the scale of the Internet, with each website or smartphone app being a “vending machine slot.”

- One Ethereum use case is Oracles. These are dapps or protocols (i.e., sets of rules that allow information to be shared between computers) that pull in information from outside the blockchain such as weather reports, sports scores, or stock prices.

- Another Ethereum use case is DEX’s (decentralized exchanges) and CEX’s (centralized exchanges). These offer users a way of easily exchanging one coin or token for another.

- Coins vs. tokens: A coin is specifically related to currency or payment, and it uses its own blockchain.

- For example, BTC (Bitcoin) is a coin because it doesn’t do much other than store value, and it runs on the Bitcoin blockchain. A token, on the other hand, could also be used for payment, but it’s programmable too, so it can do a lot more than that.

- Another example: SUSHI is the token for the SushiSwap DEX, and it runs on the Ethereum blockchain. So, if you have some SUSHI in your wallet, it not only has value as a currency, but it also helps keep the SushiSwap dapp running (which manages over $3B USD).

- Tokens that run on the Ethereum blockchain specifically are called ERC-20 tokens. There are hundreds of thousands of these (including SUSHI) that offer all sorts of functionality.

- (Incidentally, NFT’s, which we’re about to talk about, are ERC-721 tokens, which are similar to ERC-20’s—since they run on Ethereum as well—except ERC-721’s are non-fungible. You’ll learn what that means shortly.)

Because it’s programmable like a computer, Ethereum has a huge number of potential use cases. So far, the two big ones we’ve covered are oracles and exchanges.

Next, we’ll spend the rest of this post (and the next couple as well) exploring another major use case (one that’s been exploding in popularity lately): NFT’s.

Ethereum use case #3: NFT’s (non-fungible tokens)

Put simply, NFT’s are unique digital assets.

That could mean anything from a piece of art, to a digitized DNA sequence, to a weapon in an online video game world, to a virtual pet, to a digital file representing the deed of a house.

What does NFT stand for? “Non-fungible token.”

Let’s break that down:

Remember that a token is a kind of programmable cryptocurrency that lives on an existing blockchain, most often Ethereum.

The word “fungible” basically just means “interchangeable” or “non-unique.”

For example, a dollar bill is fungible because it doesn’t matter which specific dollar bill you have—they’re all basically the same.

In contrast, your birth certificate is non-fungible—there’s only one, and you can’t just swap yours for someone else’s. An original painting is also non-fungible since a print of it would be considered a copy and not an original.

So, an NFT is a unique (non-fungible) thing, except it’s not a physical object—it’s stored digitally.

When I say “unique” here, we’re talking about a digital asset that’s cryptographically signed and stored on the blockchain (typically the Ethereum blockchain).

So when you buy an NFT, it’s not just a seller telling you it’s unique—it’s proveably unique (and you can easily check the blockchain to be sure).

In other words, think of a file on a computer that you can’t just copy and paste. A file that would remain completely one-of-a-kind.

This is going to seem ridiculous at first, but I hope you’ll give me a chance to explain.

Unfortunately, NFT’s have developed a bit of a bad reputation with the general public thanks to silly stories in the mainstream media. For example, news stories will focus on how someone sold a tweet as an NFT in a way that makes it sound ridiculous. And because of that, when I first heard about NFT’s, I found myself super skeptical as well.

Even now, I certainly wouldn’t call myself an NFT enthusiast. But, I’ve come around quite a bit after a lot of reading and listening, and I now believe that this topic is significant enough to spend a good amount of time on it.

So I want to preface all of this by saying: I get it. A lot of this is going to seem ridiculous at first. But if you give it a chance, you might be surprised that this goes a lot deeper than it seems on the surface.

Let’s dive in: Why should you care about NFT’s?

First, since the term “NFT” covers so many different types of things, here’s what I suggest: Start by thinking of NFT’s as digital trading cards or special pieces of art—except, instead of being physical objects, they’re accessed via your Ethereum crypto wallet, and they live on the blockchain just like other cryptocurrencies.

NFT’s have a few attributes that make them special:

They’re provably unique, which is a fairly new concept in the digital world.

Remember why blockchain technology is so good at verifying financial transactions: Because every single transaction for all time is carefully verified and logged on the blockchain, then copied to thousands of computers all over the world. That makes it incredibly resistant to fraud, censorship, and so on.

So, if my Bitcoin wallet shows that someone sent me 50 BTC at 3:47 pm yesterday, you can trust that that’s completely accurate—all without having to contact a central bank, lawyer, or some other traditional authority figure.

Now, apply that concept to the digital trading card or art analogy—when you see that someone has an NFT in their wallet, you can absolutely trust that they’re the real owner and that what they own is completely unique.

Again, it’s truly one-of-a-kind and can’t simply be copied and pasted.

NFT’s can have both ownership and royalties (as well as all sorts of other attributes) programmed in.

With a traditional piece of art or digital creation, once the creator sells it, that’s where their compensation ends.

Since NFT’s are programmable and live on the blockchain, you can look up the record of who originally created that NFT and who currently owns it (or at least their wallet address).

The original creator can even program the smart contract so that they get a cut of the sale whenever that NFT changes hands in the future.

Let’s pause for a moment and consider how amazing this is. In the physical world, if an artist sells a painting, they have no idea what happens to it once the buyer walks away. But with NFT’s, anyone can track which wallet currently owns them, what their current value is, and their entire history of ownership.

This could be a game-changer for the art industry. Imagine an artist who sold a piece of their art that later exploded in popularity. That original buyer could now sell it for a lot of money and the artist would get a piece of the profit.

With me so far? Now, apply all of that to pretty much anything that can be represented digitally:

- Say you release a video that goes viral. In the pre-NFT world, you might not have typically received any compensation for it. But, what if there were a YouTube-like service where each video were an NFT tied back to its original creator? And what if that service were governed in a decentralized way rather than being filtered through the Google corporate machine?

- Say a scientific researcher writes an influential paper that ends up been cited hundreds of times by other scientists. What if they received a small amount of compensation each time?

- We’ll go over a lot more possibilities shortly, encompassing collectibles, music, art, and more.

This whole NFT world is so new that we’re just scratching the surface of what’s possible, and the community is still figuring out what does and doesn’t make sense as an NFT (which is why you might come across some that seem especially ridiculous or useless).

The creator of Ethereum actually tweeted recently that NFT’s are the Ethereum use case that most surprised him.

There’s a lot of potential here. And over the next few posts, we’ll explore some major categories of NFT’s that are already popular, starting with collectibles.

Category #1: Collectibles

Personally, I’ve never been much of a collector. But I know people who are. So right off the bat, please try to notice if any skepticism you feel in this section is about NFT’s specifically or about the idea of collecting something in general.

Let’s start with the assumption that collecting is a reasonable hobby—for example, baseball cards, stamps, comic books, dolls, Magic: The Gathering cards, and so on.

If you’re not familiar with it, Magic: The Gathering is a collectible card game that’s been around since 1993. It’s been incredibly popular, with more than 35 million players. The most prized card, the Black Lotus, sold in January 2021 for $511,100 USD.

Because Magic has been around for so long, over a dozen new sets (or “editions”) of cards have been printed over the years. Often, the same card appears in multiple editions, but its value can vary dramatically depending on the age and rarity of a given edition.

For example, a Beta Edition version of the Mana Vault card is valued at over $9,000 USD, whereas a 4th Edition version of that same card (released only two years later) is valued at only $71 USD.

From a gameplay perspective, they’re the exact same card. But from a collectibles perspective, it’s critical to know which edition of a card you’re getting.

This applies to all sorts of collectibles.

Two pieces of fine art might look the same to the untrained eye. But, a careful inspection by an expert might reveal that one is an original from three hundred years ago and the other is a forgery made by a skilled artist twenty years ago. Even though it took a close inspection to see the difference, those two pieces still have dramatically different values.

Whether you’re dealing with art, comic books, baseball cards, or whatever else, the value of a given object depends on things like:

- If it’s legitimate (not a forgery),

- How old it is, and

- How rare it is.

But how can you know those things for sure?

To check the legitimacy and age, you could hire an expert to inspect the object for you. And for rarity, you could try to research how many were originally printed, but it might be iffy to get at a conclusive number.

What if you thought you owned a rare comic book but it turned out that many thousands of them had been printed?

NFT’s make all of this a whole lot easier.

For any NFT, you can simply open up its record on the blockchain and see exactly when it was made, how many copies of it were created, and the exact path it took to get where it is now (i.e., who first created it, who bought it from whom, etc.).

(Technically, you’ll just see the trail of wallet addresses rather than actual people. But, if you want to buy an NFT and aren’t sure who the owner is, there are various online marketplaces and discussion groups you can use to try to track them down.)

As we keep moving toward a truly digital-first world, will that destroy the concept of collectibles?

Nowadays, a lot of people are already reading books exclusively on their Kindles rather than the print editions. What if that trend continues and comic books and trading cards become purely digital too?

If that seems clumsy or far-fetched, imagine the tech we’ll have a decade from now: cheap, paper-thin, bendable screens with huge battery life.

Think about how both work and play have moved increasingly online during the pandemic. A lot of people want to be able to play games with friends or strangers who live far away, and that’s probably not going to dramatically change even when things go back to “normal.”

Well, a popular online version of Magic: The Gathering already exists alongside the paper version. And because the collecting aspect (including the concept of rarity) has been such an important part of the Magic experience, that was carried over into the digital version as well. In other words, long before NFT’s existed, digital Magic cards already had certain rarity values assigned to them, and they were worth real money.

NFT’s still represent something new here.

Let’s explore a few different ways that collectibles (and rarity) could work in the digital world.

When it comes to digital assets like virtual trading cards, I see three main directions things could move in:

- The concept of rarity disappears, and therefore the entire hobby of “collecting things” disappears as well. There’s no longer a concept of an “original run” version of a card or a “special edition” version of a comic book. Instead, there’s an infinite supply of formerly-rare Black Lotus cards, and they’re all exactly the same.

- We increasingly rely on centralized DRM (digital rights management). This is how most streaming music, TV, and movie services work today, and it will remain the most likely situation if crypto fails. If that seems like no big deal, think about all the issues that exist around not “truly owning” the digital products you buy:

- For example, what happens to all your music if Spotify dies? What happens to all your ebooks if Amazon decides to ban the smartphone you read them on for some reason? Each of these companies likely promises that they’d find a positive solution if their company went bankrupt, but the point is that they have complete power to decide what happens to the music, movies, books, TV shows, and so on that you paid for.

- With DRM tech, they’re able to modify or remove the digital assets that live on your phone without your permission (here’s a story about someone who had all their paid-for books remotely wiped from her device by Amazon—with no real explanation or opportunity to appeal the decision).

- If you carefully read the user agreements on all these services, you’ll find that you don’t actually own the book, song, TV show, etc. you bought—only a limited license to it.

- Blockchain-based NFT technology allows users to actually own the thing. Plus, it has a built-in “certificate of authenticity”—there’s an indisputable record of where the person got it along with any other relevant information. You can confirm that the NFT is an original and that it has a certain level of rarity—all without needing to get third parties involved.

So no, a digital-first world doesn’t have to destroy the concept of rarity or the practice of collecting things.

But how does the concept of rarity actually apply to digital items? Aren’t digital items infinitely copyable?

Maybe, maybe not.

With NFT’s, someone might create a new collectible trading card game and decide to make two versions of the same card.

Those two versions might look exactly the same except for one thing:

- One is part of a “first run set of 5” (i.e., rare), so it has a little “#3 of 5” written in the corner or in the metadata of the card.

- The other is part of a “second run set of 5,000” (i.e., common), so it has a little “#289 of 5,000” written on the card or in the metadata.

Because of that, if the new game becomes popular, it’s very likely that the rare first run set will end up being worth a lot more money than the common second run set.

You might be thinking: “This is ridiculous—it’s the same card! How can one be common and one be rare just because the creator says they are? They’re all just digital copies of the same thing, and digital things could technically be duplicated a million times with no loss of quality, so the idea of rarity doesn’t make sense.”

Possibly, and it’s certainly a philosophical debate.

But we humans do seem to enjoy the concept of rarity in general, even if the functionality is pretty much identical. So, philosophically, one might say that there would be something sad about moving to a highly digital world where everything is infinite and it’s no longer possible to feel like you own something precious and special.

NFT’s allow us to retain that feeling of preciousness—even in a digital world.

Plus, as you’ll see below, there’s a lot of cool stuff that can be done with NFT’s to make the concept of rarity seem less artificial and more interesting.

There’s more to this. Remember how Ethereum is fully programmable?

People already enjoy collecting sports cards just for the collectible aspect. But, if you’re a sports fan, imagine playing fantasy football with NFT-based collectible trading cards that respond to real-world events.

Imagine if the card for each football player were programmed to automatically change its stats (and rise or fall in value) as that person became more famous, broke records, or won championships.

Let’s go even further: What if NFT trading cards weren’t just trading cards?

VeeFriends

In May 2021, popular entrepreneur and digital marketer Gary Vaynerchuk released an NFT collection called VeeFriends.

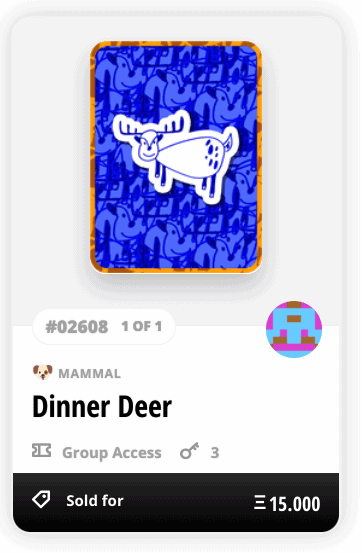

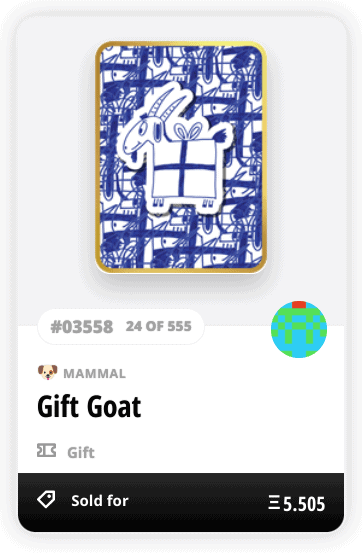

VeeFriends is a collection of 10,255 NFT’s that look like trading cards. They all feature artwork drawn by Gary and can be collected and traded just like any normal, limited-run collectible.

But Gary went a step further by giving many of the cards special attributes that connect to real-world rewards. For example:

- The “Admission” cards give the holder access to Gary’s high-end in-person conference for as long as they hold it (up to three years).

- The “One-on-One” cards give the holder access to specific activities with Gary, like a mentoring session, a podcast appearance, or even a basketball game with him and his friends.

- The “Gift Goat” cards put you on Gary’s list to be sent physical gifts in the mail six times a year.

(Those numbers on the bottom-right are prices in Ethereum. Yes, Dinner Deer sold for over $30,000 USD.)

What’s interesting about these cards is that they’re a combination of (1) admission ticket or subscription service and (2) collectible or investment.

Gary hasn’t actually held a conference or sent out gifts yet, so no one knows how desirable those will end up being. If they flop, the value of the NFT’s will go down; but, if they turn out to be awesome—and these limited NFT’s are the only way to access them—the value of the NFT’s will rise, and the NFT owners will have to decide if they want to sell them or hang onto the cards to continue getting rewards.

VeeFriends are the first example of this kind of thing I’ve seen, but I imagine this will become increasingly popular in the future.

CryptoKitties

Another example of trading cards with real functionality behind them is CryptoKitties. These are more like a cross between collectible cards and virtual pets.

They were one of the first collections of NFT’s to get people excited since they were cute, collectible, and had a game element to them: You can “breed” two CryptoKitties you own to create a new kitten that takes on some of the characteristics of each parent.

Some characteristics are more rare than others, so each time you breed, you’re rolling the dice in terms of how valuable your new kitty will be.

Category #2: Research Funding and Historical Significance

This category is highly experimental right now, but I wanted to briefly include it since it hints at some of the ways NFT’s might be useful beyond just the most common use cases of collectibles and art.

In June 2021, UC Berkeley auctioned some documents related to Nobel Prize-winning research around an immunotherapy breakthrough and CRISPR gene editing discovery.

It wasn’t simply a scientific paper that was being auctioned, but related documents like handwritten annotations that the scientists thought would be interesting to the public and of historical significance. Sure, they could have just released all that as a standard PDF that can be copy and pasted, but this way it’s all packaged into a unique NFT that a single person now owns.

It ended up selling for nearly $55,000, and this model could represent a way of funding scientific research in the future.

Category #3: Music

The music NFT space is still very young, but there’s huge potential there.

Ever since we transitioned from CD’s to MP3’s (and likely even before that), proper compensation has been tricky for musical artists. Spotify pays them as little as $.0033 per stream.

What if an artist could set the price of an NFT of their song, and the smart contract would ensure they were paid, even without a middleman like Spotify, Apple, or a traditional publisher?

Again, this space hasn’t been very developed yet, but here are some possibilities that don’t seem too far away:

- Smart contracts where a musician could encode different price points and compensation options—maybe regular consumers pay one price, but production companies pay a different one to feature that song in their commercial or movie.

- Maybe the artist generates a list of everyone who owns a copy of their song NFT, and they somehow feature those fans during a live concert. Maybe all their names appear on the screen, or maybe those owners get free access to the recording of the live version of the song afterward.

- Sure, things like Patreon already exist today, but that’s another centralized service. With NFT’s, the artist could easily check the Ethereum blockchain to find the wallet addresses of everyone who purchased their NFT. Then, the artist could send each fan a special token that would appear in their wallet, all without needing to rely on a company like Patreon, Ticketmaster, or a music publisher. That way, the artist isn’t locked into the rules and whims of a central entity like Patreon for their livelihood. They’re free to take their list of fans with them to any blockchain-based platform.

- Theoretically—once the legal structures are worked out—there could be a complex smart contract like this:

- You’re a superfan who buys partial ownership of a song from a less well-known artist. Eventually, that song gets featured in a commercial and explodes in popularity. Now, not only does the original artist get compensated, but you get a piece of the profit too since you believed in it early on and were willing to invest in it before it was popular.

The ecosystem isn’t quite to that level of sophistication yet.

But, the band Kings of Leon announced in March 2021 that their new album, When You See Yourself, would have an NFT version. Fans who purchase that version will get perks like front-row seats for life at live shows, a VIP experience with exclusive merchandise, etc.

Generative Music

Another completely different category of audio NFT is generative music—music created by a computer according to rules laid out by the artist-programmer.

DeafBeef is one example. It’s a generative music NFT that’s created at the time of purchase based on a random value that seeds various attributes like tempo, timbre, and pitch. (The music doesn’t change after that initial creation, at least in the case of DeafBeef.)

In other words, every single buyer gets a completely unique piece of music, and they can’t preview it before buying because it doesn’t exist yet. DeafBeef is all fully on-chain (i.e., “on blockchain”), meaning it’s not just linking to an MP3 stored on a server somewhere; it’s generating the sounds in real-time based on code stored on the blockchain.

Not only that, but this music will never be lost unless the entire Ethereum blockchain is shut down.

You can browse DeafBeef and listen to what it sounds like here.

This post got so big that I decided to split it into three. In the next part, we’ll explore some more NFT use cases: art, video games, online worlds, and the future of virtual reality.

Part 10: More categories of NFT’s (art, video games, virtual reality)

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.