Welcome to my free cryptocurrency educational series. Each part builds on the previous ones, so I suggest starting at the beginning and moving through part by part:

Cryptocurrency 101 series (core principles, social justice, blockchain tech, Bitcoin):

- Part 0 Overview of my series, who this is for, why you might consider listening to me, and how easy it is to think you understand crypto when you actually don’t.

- Part 1 Why should I care? What’s in it for me? Why is crypto important (it’s about a lot more than just making money!)?

- Part 2 How crypto actually works, why Bitcoin is valuable (even if it’s just “made up!”), and what you should know about blockchains (the tech behind them and how they could influence the future of our world)

- Part 3 How the blockchain keeps running, where new Bitcoins come from (i.e., how mining works), and concerns about Bitcoin’s environmental impact

- Part 4 How crypto offers autonomy, why it can’t be stopped, and the value of decentralization

- Part 5 How to store and use cryptocurrency, some basic cryptography, how wallets work, identity management, and the future of democracy

- Part 6 Overview of the different types of wallets, which one is best for you, what to be careful of, and why a hardware wallet might be worth the investment

Cryptocurrency 201 series (intermediate principles, Ethereum, NFT’s, DAO’s):

- Part 7 Ethereum (the #2 most popular cryptocurrency, and the one I’m most excited about), smart contracts, dapps, gas (and the high gas fee problem), Proof of Stake (PoS), and Ethereum 2.0

- Part 8 Coins vs. tokens, and some real Ethereum use cases—oracles and DEX’s

- Part 9 Intro to NFT’s (collectibles, research funding & historical significance, and music)

- Part 10 More categories of NFT’s (art, video games, virtual reality)

- Part 11 Wrapping up NFT’s (what you can actually do with them, upsides, downsides, risks)

- Part 12 DAO’s (organizations managed by algorithms, governance tokens, collective ownership, and the “network state”)

Cryptocurrency 301 series (advanced principles, DeFi, reinventing the finance world):

- Part 13 DeFi & CeFi, reinventing banking with peer-to-peer finance, stablecoins, and borrowing & lending

- Part 14 More DeFi (how Uniswap works, plus insurance, payments, derivatives, blockchains, exchanges, liquidity staking, and impermanent loss)

- Part 15 Wrapping up DeFi (why liquidity is important, LP tokens, yield farming, calculating return, yield aggregators, and major risks)

Cryptocurrency 401 series (investing, making money in crypto):

- Part 16 Intro to investing (what could go wrong, where you might fit in, and what kind of investing could be right for you)

- Part 17 Preparing to invest (how much money to put in, how to split it up to mitigate risk, setting up your wallets, buying the coins & tokens you want, and dealing with different blockchains)

- Part 18 More preparing to invest (security, understanding what price targets are realistic, and using “expected return” to choose between opportunities)

- Part 19 Specific investing options (buying and holding, index tokens, leveraged tokens, my list of coins and tokens, mining & staking, and lending)

- Part 20 Higher-risk, higher-reward opportunities (liquidity staking & yield farming, NFT’s, OlympusDAO, and Tomb Finance)

- Part 21 The single investment that’s made me the most money: StrongBlock

- Part 22 Wrapping up my seven categories of investment (including an update on StrongBlock)

- Part 23 How to invest depending on how much money you have (plus, the market dip, where my money is, and how to fit crypto into a larger investing strategy)

- Part 24 Holding coins & tokens vs. yield farming, where I’m putting my money now, big news on StrongBlock, and the future potential of crypto

- Part 25 Staying safe, preparing your taxes, avoiding scams, upgrading your security, and judging new projects

- Part 26 How to decide who to trust in the crypto world, technical analysis & market cycles, and an update on my longish-term portfolio

This is part 8 in my cryptocurrency educational series.

Part 8 Reading Time: 23 minutes

Want to listen to this post instead?

What can Ethereum do? A lot more than just “store value”!

Remember that Ethereum is like a giant multi-purpose vending machine. You pay some money (ETH, plus the gas fee) and get some kind of good or service in exchange.

There’s a lot of complexity behind the scenes; but, as the user, you’ll just see your crypto wallet lose some ETH and gain whatever it is you bought.

Those “vending machine slots” are each running a dapp (decentralized app). So, when you “buy something,” you’re actually triggering a dapp to run that has a smart contract inside it.

That smart contract was programmed with specific rules that can’t be modified. It can’t be censored, secretly changed, or controlled by a third party. In other words, it gives you the security of an unbreakable agreement without having to hire a lawyer.

Ok, why is that interesting?

Imagine the intersection of:

A wide variety of apps that can do all sorts of things

Pretty much any type of app you can think of could be connected to blockchain technology. I’ll be going into some of the coolest ones later in this post and the next one.

The ability to securely own digital assets so that they can’t be taken away by a company or government

If your government turned corrupt and you needed to escape, all you would need are the keys to your crypto wallet (which could be written on a piece of paper or even stored somewhere on the Internet), and you could flee to another country without having your assets seized on the way out.

The ability to quickly, easily, and cheaply send and receive assets, all without a central bank (not only money, but digital art, items in video game worlds, votes, ownership of real-world objects, and more)

Imagine something like Venmo for easily sending money to friends—except neither one of you needs a bank. And imagine receiving that money instantly instead of several days later. (Yes, transfers appear to go through on Venmo instantly; but, in many cases, it takes substantially longer for the funds to actually be available in your bank.)

(The other day, I sold some stock in my brokerage account to buy more crypto, and it took 7 days for the money to arrive in my checking account. That’s ridiculous in 2021. When I sell crypto, I get it virtually instantly.)

Now, take those ideas even further and imagine running a virtual company that employs people all over the world—including in developing countries where they don’t have solid banking infrastructure.

Imagine building your company on smart contracts so that everyone automatically receives their paychecks virtually instantly—not only without costly international wiring fees, but without any accountants on staff.

Cryptographically secure communication and information encoded into the blockchain—meaning things like:

- Pseudonymous representation, allowing you to have an online identity that’s not tied to your real-world identity but where it’s still clear that you’re the one who wrote or created something. In other words, imagine blockchain-based versions of Twitter and YouTube where you could create videos and tweets under a pseudonym, but everything you make is cryptographically signed by you. So even though they don’t know your real identity, your viewers or readers can be sure that this content came from you.

- A record of events can be logged in the blockchain such that nobody can ever change them. For example, imagine a law is passed in the future requiring all police departments to run AI on their bodycams. That AI automatically logs all relevant arrest data on the blockchain, and that data can never be tampered with or censored. So, even if the police department or government notices that something makes them look bad, it’s already out there on the public blockchain for the rest of time and can never be changed. (To be clear, nothing like this exists yet, but a lot of the foundation is being laid to make something like this possible in the next couple of years.)

- Think about how often in history inventions were stolen and patented or marketed by someone other than the original creator. Now imagine that the blockchain recorded the very first usage of that invention or that piece of art or creativity. It would be absolutely and indisputably clear who the first person ever to create that was. And, the smart contract could be programmed so that the inventor automatically got a cut of the profit from anyone else who ever used that invention or sold that piece of art in the future.

That’s all nice in theory, but let’s jump into some real examples.

Here are five big categories of use cases (dapps and protocols) that already exist on the Ethereum blockchain:

- Oracles (to pull in information from outside the blockchain)

- DEX’s (to exchange one type of cryptocurrency for another)

- NFT’s (to provide ownership of a digital item or piece of art)

- DAO’s (to allow anyone to start something like a corporation)

- DeFi & CeFi (to reinvent traditional finance/banking/investing in the crypto world)

Oracles and DEX’s might not be the most exciting of those use cases, but I’m going to start there since it will help lay some important groundwork for your understanding of the other types. Then, in the next few posts, I’ll dive into #3, NFT’s.

Ethereum use case #1: Oracles

Oracles pull in information from outside the blockchain.

Remember that the blockchain is a record of all transactions. That’s the data it has. But, there are many cases where a dapp running on the blockchain wants to know about other things, like real-world events. For example: the weather, stock prices, election results, etc.

An oracle interfaces with other, more traditional sources of information, and it converts that data into a format that other dapps on the blockchain can understand.

The more interesting oracle dapps go even further: Rather than just trusting a single source of information, they’ll ask the same question to many different sources. And over time, they compare and learn which sources should be trusted more or less. You’re probably thinking that this sounds like a huge challenge.

It is.

How do you know which sources to trust?

That’s called the Oracle Problem in computer science, and a lot of smart people are working on it. I won’t claim to fully understand the proposed solutions myself; but, I know that one piece of the puzzle is getting data from many different sources and prioritizing consensus (i.e., if many different sources are saying the same thing, it’s more likely to be correct).

Again, remember that one of the core ideas behind cryptocurrency is decentralization, meaning that we’re trying to never rely on only one single entity to give us information (because that gives that entity too much power, and it opens the door to control, coercion, or censorship).

Seem like an obvious thing to do?

This is actually quite different from most traditional apps.

For example, if you have an app on your phone that shows you stock prices, it’s most likely pulling all that data from one single source. If that source is wrong, the data displayed in the app is wrong.

The idea with crypto oracles is that, ideally, they should be pulling from many sources of information so that no one entity could trick them, censor them, or promote a nefarious agenda.

The most promising oracle is Chainlink (LINK).

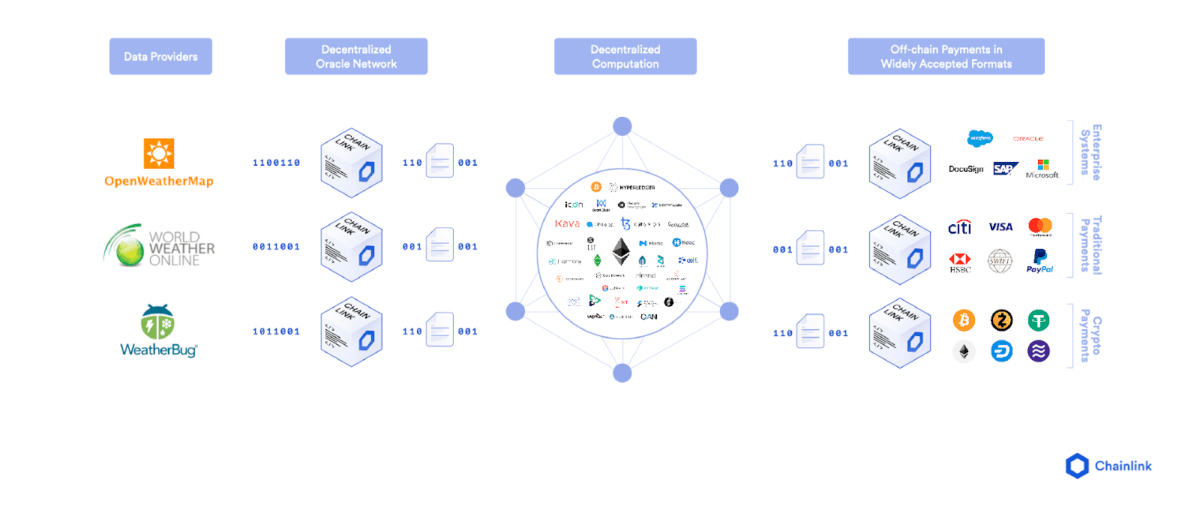

Chainlink can pull in things like weather data, sports data, shipping data, commodities data, payment data, and more—even data from other blockchains competing with Ethereum.

(source)

(source)

(source)

Interlude: What are tokens?

Now that you understand one tangible use case for Ethereum, I want to pause to explain an important concept.

First, remember the core advantage of Ethereum over Bitcoin. Bitcoin is like digital gold—it’s not “smart.” It just sits there storing value over time. Ethereum is more like “programmable money,” meaning it’s both a currency (ETH has value) and a blockchain network that runs dapps that use that currency.

So, Ethereum is both a type of infrastructure as well as something you can pay people in.

In conversation, it’s easy to tell the difference if you say “That piece of art cost me 2 ETH” versus “This dapp runs on the Ethereum network.” Make sense?

In terms of terminology, Bitcoin (BTC) and Ethereum (ETH) are both cryptocurrencies or crypto coins. But another common crypto term you’ll hear is “token.”

Many people think “coin” and “token” are synonymous, but they’re not quite the same.

There are two important differences between coins and tokens:

- A coin is related to payments (i.e., using a cryptocurrency as money). So, you’d pay for things with coins like BTC and ETH. In contrast, a token can be used for payment, but it has other uses as well (i.e., it’s programmable money).

- A coin is used on its own native blockchain (i.e., BTC is used on the Bitcoin blockchain, and ETH is used on the Ethereum blockchain), whereas a token is something new that uses an existing blockchain.

For example, say I created a brand new cryptocurrency—it would be a coin if I also made a brand new blockchain for it, but it would be a token if it used the Ethereum blockchain instead.

As you might imagine, it’s a lot of work to create a new blockchain from scratch. It involves building new software and then enticing lots of people to run nodes to create the new distributed blockchain network and validate its transactions.

Here’s the magic of Ethereum, then:

It already has a huge, powerful, and trusted blockchain network in place, so it’s easy for developers to create new tokens to run on the Ethereum network.

Ethereum tokens specifically are called ERC-20 tokens. This is important because an ERC-20 token can’t be used on a different blockchain (like Bitcoin’s).

Here’s the easiest way to tell whether or not a token is ERC-20 (i.e., if it runs on the Ethereum blockchain network):

- Go to Etherscan.io.

- Search for a token (for example, LINK, from the Oracles section above).

- On the LINK page, next to Overview, you’ll see it says “ERC-20.”

You can store any ERC-20 token in your Ethereum wallet. If you want to buy a non-ERC-20 token, you might need a different wallet that supports that blockchain.

Why is all this important?

Remember the oracle Chainlink (LINK) that I explained earlier?

It’s an ERC-20 token running on the Ethereum blockchain. So, just like Ethereum, it has two parts to it:

- The LINK token is a cryptocurrency. In other words, you can hold LINK tokens in your wallet, and they have a monetary value. My favorite site for tracking coin and token values is Coingecko. You can find their LINK page here. At the time of this writing, 1 LINK is worth $22.08 USD, and there’s currently a circulating supply of 432,509,553, meaning there are that many LINK tokens in usage in the world, for a total value of over $9B.

- Chainlink is also a protocol (a “protocol” is just a set of rules that allows information to be shared between computers), so it has programming that allows it to perform its functions as an oracle. The protocol involves smart contracts that run on the Ethereum blockchain network. So, Chainlink itself isn’t a dapp, but it’s a service that Etheruem-based dapps use. For example, if you had an Ethereum dapp that allowed people to place bets on sports games, that dapp might rely on Chainlink to pull in the latest sports scores from various sources.

It can be a bit confusing to wrap your head around this.

It’s almost like Chainlink is a company, and LINK is its stock. So, if you believe in the future of Chainlink, you might “buy stock in it” by buying some LINK in your Ethereum wallet. But it’s not quite the same:

- For example, when you buy the stock TSLA, you’re buying a legal representation of a piece of the Tesla company; but, a unit of TSLA stock isn’t really related to a car.

- When you buy LINK, you’re buying a piece of the Chainlink project. As more people get on board, just like with a stock, the value of LINK will go up due to supply and demand. But, what’s different is that you’re also buying the actual thing that’s used to incentivize the node operators—the people who run the node computers that power the Chainlink network by validating transactions and executing smart contracts. Just like how people running Bitcoin nodes are rewarded with BTC for their work, people running Chainlink nodes are rewarded with LINK tokens. And, the value of those LINK rewards goes up as the project grows.

- It’s kind of like if the Tesla car factories were run completely by robots and those robots were powered by Tesla stock. That way, not only would the value of the stock go up as demand went up, but it would be like the stock was literally powering the production of the cars. That’s what’s happening here: The LINK token literally keeps the Chainlink protocol operating.

Phew!

All that was just about Chainlink specifically, but something very similar applies to the other Ethereum use cases I’ll be discussing here and in the next few posts.

Bottom line: When you own a token like LINK (or the thousands of other ones that do different things), it’s not only a store of value like money, but it’s also a piece of the dapp or project associated with it (e.g., Chainlink in the case of LINK).

Owning a piece of that project allows you to do a few cool things that I’ll get into in a future post (e.g., voting on proposals or “staking” the token to generate money from it).

Ethereum use case #2: DEX’s

Next up is a type of dapp called a DEX, or decentralized exchange.

DEX’s offer users a way of easily exchanging one coin or token for another.

There are over 10,000 cryptocurrencies (a combination of coins and tokens), so there are a lot of use cases where you’d want to convert between them. And, in the usual spirit of crypto, the goal is to do that more efficiently and cost-effectively than the traditional method (e.g., currency exchange booths at airports or banks that make the process overly bureaucratic and expensive).

So, let’s say you have some ETH and you want to use it to buy some LINK (or, put another way, let’s say you want to convert some ETH to LINK).

There are two major ways you could do that: Through a centralized exchange (CEX) or a decentralized exchange (DEX).

Centralized Exchanges (CEX’s)

These are things like Binance, Coinbase, and Kraken. There are dozens (or hundreds) of exchanges, but many smaller ones feel shady to me. You should be quite safe with the three I just mentioned, though.

Centralized exchanges are the most common way people enter the crypto market.

On Coinbase (my exchange of choice; no affiliation), you can easily connect your bank account, withdraw US dollars, and use that to buy Ethereum. Then, right within Coinbase, you can convert that ETH into LINK for a small fee. Or, when it comes to LINK and other common cryptocurrencies, you can actually jump straight from USD to that token (e.g., LINK).

In either case, Coinbase is acting as the “middle man.”

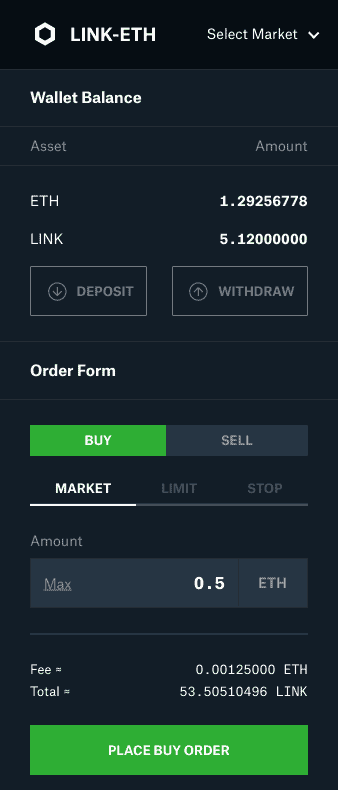

Here’s how all this looks in Coinbase Pro:

Let’s go through all that piece by piece:

- At the very top, it’s showing that we’re setting up a conversion between LINK and ETH.

- Next, it shows that my wallet currently has 1.29 ETH and 5.12 LINK.

- Then, it’s asking me to enter how much ETH I want to spend, so I put in 0.5.

- Finally, it’s offering me the preview that, with a fee of 0.00125 ETH, my 1.29 ETH will convert to 53.5 LINK.

- (I’m not sure exactly how that 0.00125 ETH fee breaks down, but I suspect it’s a combination of a gas fee that goes to the validator node plus a fee that Coinbase charges to use their service.)

All this generally works well, but remember that one of the core goals of cryptocurrency is decentralization. So, it’s not ideal that a $46B company (Coinbase) is at the center of all these transactions. If they were ever hacked or turned evil, they could freeze all the conversions from happening.

Decentralized exchanges address that concern.

Decentralized Exchanges (DEX’s)

A DEX runs on smart contracts that govern a complex self-running ecosystem for handling conversions without a “middle man.”

Some of the most common DEX’s are Uniswap, PancakeSwap, and SushiSwap (yes, they impressively got the domain name sushi.com).

With a DEX, the smart contracts handle everything—conversions from one coin/token to another are effectively user to user rather than going through a central organization.

From the user’s perspective though, everything is presented via an easy web interface. You never have to find a trading partner yourself—the smart contracts handle all that for you.

As a user, all you have to do is enter the amount and type of coin/token you have and what you want to convert it to.

Then, the web app will show you how much of the target coin/token you can get, including a fee—but with a DEX, the fee goes to whichever user is selling the coin/token that you want (typically, it’s not going to be a single user though, but a rather a pool of users who divide up the profits whenever one of them sells a coin/token—and again, all of this is automatic and easier than it sounds).

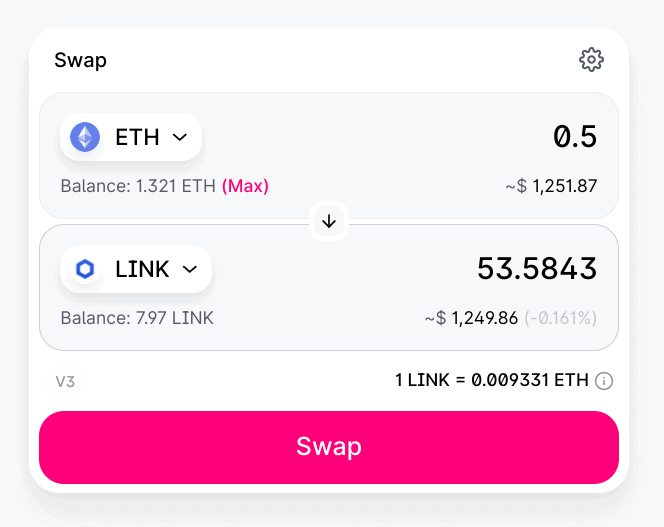

Here’s what all this looks like in Uniswap:

Let’s go through what’s happening there:

- We’re swapping ETH for LINK.

- In my wallet, I currently have 1.321 ETH and 7.97 LINK.

- How much ETH do I want to convert? I entered 0.5, which it tells me is currently valued at $1,251.87 USD.

- It offers me the preview that my 0.5 ETH will convert to 53.5843 LINK (which is valued at $1,249.86, which is less than the ETH value because of the fee).

- With a DEX, once I hit Swap, my wallet will open up and tell me how much gas it will cost; then, I can approve or deny the final transaction.

One more important point here:

Just like Chainlink (LINK) is both a functioning protocol as well as a tradeable cryptocurrency, so too are all the major DEX’s.

For example, the ERC-20 token UNI represents Uniswap, and the ERC-20 token SUSHI represents Sushiswap. People who support Uniswap are rewarded in UNI, and as the Uniswap DEX grows in popularity and value, the value of the UNI token goes up too.

So, if you buy some UNI or SUSHI, you’re both supporting that project as well as investing for your own monetary gain (i.e., hoping that the value of that token goes up over time, which they have—in four months, from early January to late April of 2021, UNI went from a low of $4.74 to a high of $42.77).

So, which should you use: a CEX or a DEX?

Ultimately, whether you choose to use a CEX or a DEX comes down to considerations like:

- Which is more convenient

- Which you feel more comfortable with

- Which offers you the best price

- (Which mascot you like best: 🦄 or sushi 🍣)

Also, each exchange only supports certain cryptocurrencies, so you might have to shop around if you’re looking to buy a less common coin or token.

Here’s generally how things play out:

- When a new cryptocurrency starts out, you can usually only get it directly from the creators (either as a direct transfer from them or by buying it through their website with ETH or another major cryptocurrency they take payment in).

- As the new cryptocurrency grows, the creators convince a DEX like Uniswap to support it.

- After a while, if one of the big CEX’s like Coinbase sees the new cryptocurrency’s potential (or their users are demanding it), they’ll make it available on their exchange.

So, in general, if you can buy into a new cryptocurrency when it’s at step 1 or 2, you’ll make more money if it explodes (once it’s easier for less-hardcore people to get it).

But, the downside is that it’s riskier at that stage since it’s not so popular yet, so you might get scammed, or it might never end up taking off.

Conversely, if you wait till it’s available on Coinbase or Binance, you can probably feel more trust that it’s not a scam; but, you’ll have lost some of the upside since it’s already more mainstream.

Interesting stuff, huh?

That’s just a small sample of the types of things you can already do on Ethereum today.

In my next post, we’ll cover another major use case for Ethereum: NFT’s. (If you’ve already heard a bit about them, they’re probably not quite what you think!)

Part 9: Intro to NFT’s (collectibles, research funding & historical significance, and music)

P.S. Crypto is one of my newest passions, but my overarching focus in life is personal growth and intentional living. Do you want help with challenges like confidence, decision-making, or idea overwhelm? I’m a transformation coach who helps analytical thinkers get unstuck, find consistent motivation to take action, and design their life purpose. Read more about me here or my coaching practice here.